Terra Insurance Services Is Now a Proud Geico Partner! Get a Geico Quote Today!

Terra Insurance Services Is Now a Proud Geico Partner! Get a Geico Quote Today!

Florida has the highest home insurance rates in the country. If you want to protect your property and your wallet, finding the best homeowners insurance in Florida isn’t optional—it’s essential. This 2025 guide breaks down rising risks, coverage options, and ways to save.

Florida homeowners pay the highest average premiums in the U.S.—more than three times the national average, according to Bankrate’s 2025 data. That’s due to three key factors:

Understanding these drivers helps Florida homeowners make smarter coverage choices—and avoid overpaying for protection.

According to MoneyGeek, these three providers stand out:

To summarize, choose:

Florida homeowners insurance policies are comprehensive; they protect your home from many perils. Your policy generally covers the structure, including walls, roof, and foundation. It also protects other structures, like your detached garage or shed.

Personal belongings inside your home also receive coverage, including furniture, clothing, and electronics. Most policies offer replacement cost coverage, meaning the insurer pays for brand-new items.

Liability protection is another key component. This protects you if someone gets hurt on your property. It also pays for damage you cause to other people’s property. Medical payments coverage helps with smaller injuries.

Loss of use coverage is also important. If your home becomes uninhabitable, this crucial assistance pays for temporary living expenses, including hotel stays and meals. Your policy provides significant financial stability.

Ask if your homeowners insurance covers common perils such as fire, windstorms, and hail. Your policy should cover theft and vandalism as well. Burst pipes and specific water damage may also apply.

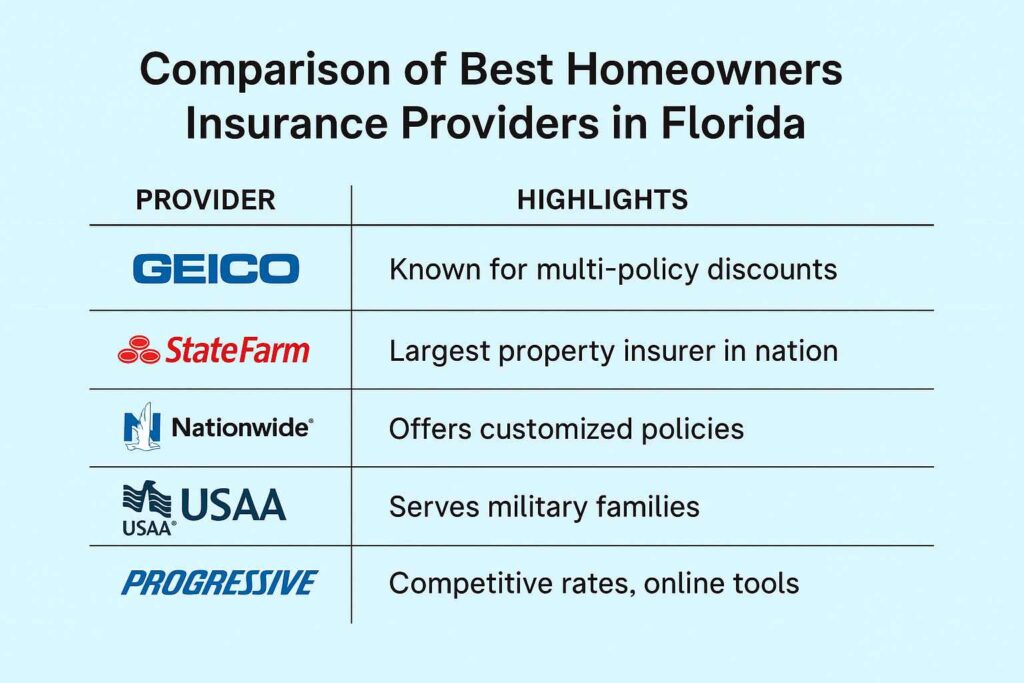

Many companies offer great homeowners insurance in Florida, but the “best” choice truly depends on your specific needs. Here are the top five home insurance providers in Florida:

Not sure which one is right for you? As an independent agency, Terra Insurance Services helps you compare these top providers and find the best fit.

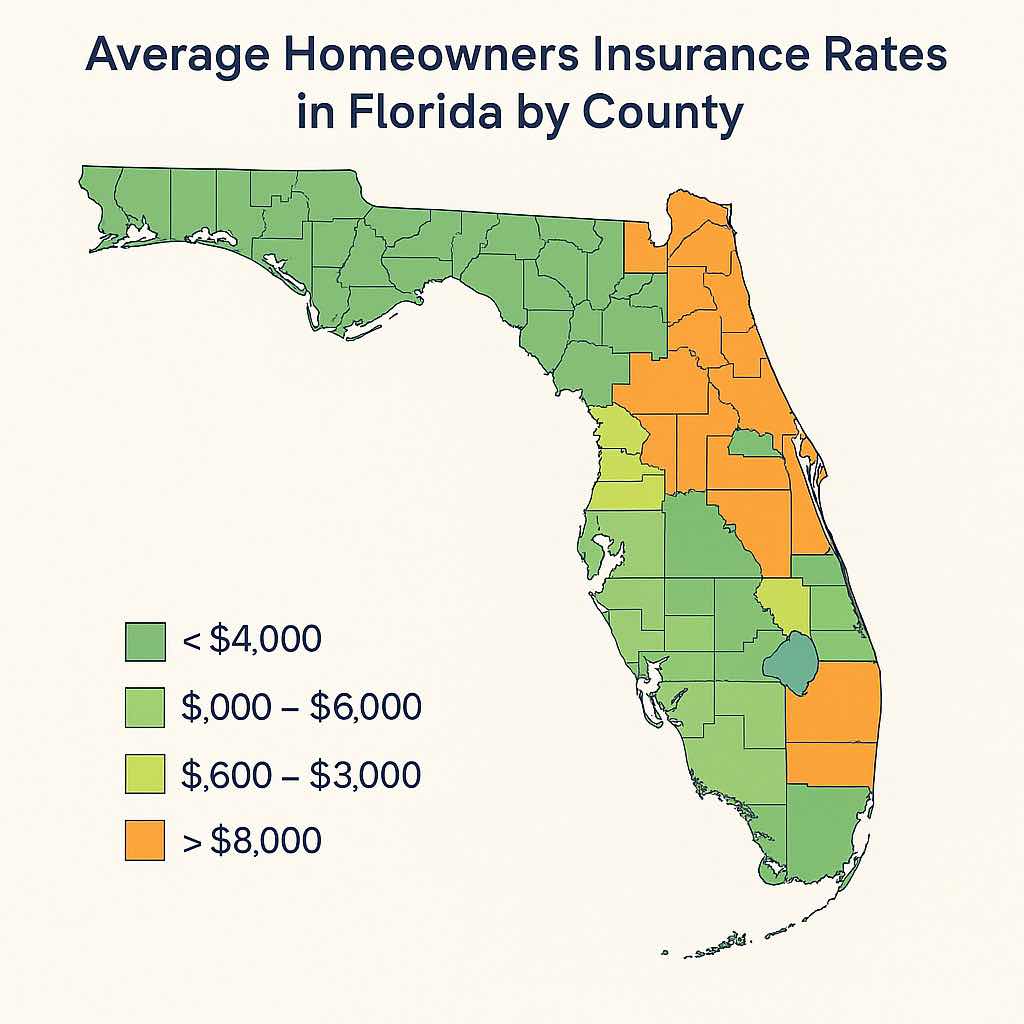

The average home insurance cost in Florida varies greatly by region. For instance, coastal areas typically pay more because they have higher hurricane and flood risks. Inland areas often have lower premiums. Your exact location significantly impacts your rate.

Here is a table showing approximate annual average rates by region:

Region | Key Cities/Counties | Estimated Average Annual Premium |

Southeast Florida | Miami-Dade, Broward, Palm Beach (e.g., Miami, Fort Lauderdale, West Palm Beach) | $12,000 – $17,000+ |

Southwest Florida | Lee, Collier, Sarasota (e.g., Fort Myers, Cape Coral) | $7,000 – $9,000 |

Panhandle | Escambia, Bay, Leon (e.g., Pensacola, Tallahassee) | $2,500 – $7,500 |

Central Florida | Orange, Hillsborough, Pinellas (e.g., Orlando, Tampa, St. Petersburg) | $4,000 – $6,000 |

Northeast Florida | Duval, St. Johns (e.g., Jacksonville) | $2,500 – $4,000 |

Estimates as of 2025. Actual premiums may vary based on your home’s location, condition, and coverage choices.

Choosing the right coverage involves several (and practical) steps:

Don’t guess—let Terra’s licensed Florida agents help you customize the right coverage.

Storm protection in Florida doesn’t stop with your base homeowners policy. Standard homeowners insurance policies do not cover flood damage, so you need a separate flood insurance policy. Mortgage lenders often require flood insurance for homes in designated flood zones.

Your main policy typically includes hurricane coverage. However, it often comes with a separate deductible that applies specifically to hurricane-related damage. This deductible is usually a percentage of your dwelling coverage.

Always review your hurricane and flood coverage in detail, including when the deductible applies. It usually triggers when the National Weather Service names a hurricane or issues a watch/warning. Consider adding extra coverage for specific risks. Ensure your policy covers severe weather.

You’ll find more information on this topic at the Florida Office of Insurance Regulation.

Discounts and strategies exist to help you reduce your premiums. Here are seven ways to save on your policy:

A licensed independent agent can help you uncover hidden discounts and match you with the right carrier. That’s where Terra Insurance Services comes in.

At Terra, we take pride in our clients’ positive feedback. Our Google Reviews reflect our commitment to quality of service and customer care. We encourage you to read our reviews and see why so many Philadelphia drivers trust us with their car insurance needs.

Getting the best deal on affordable home insurance in Florida requires a proactive approach. You must shop around diligently. Do not settle for the first quote; instead, compare rates because policies from local and national carriers vary greatly.

Here’s a short list of things you can do to find the best deal:

Terra Insurance Services has vast experience in the field, regularly helping Florida homeowners find the coverage they need. We also offer Florida commercial auto insurance and other insurance options for businesses.

Talk to Terra today—our agents work for you, not the carrier.

The right homeowners insurance policy safeguards your investment, and Terra Insurance Services specializes in tailored solutions. We work with top-rated carriers, and our goal is to find you the best coverage. We prioritize your protection and also your peace of mind. We’re backed by 5-star reviews and staffed with licensed Florida insurance agents who put your needs first.

Get a custom quote from Terra Insurance in 60 seconds.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.