Florida trucking businesses rely on the right combination of insurance policies to stay protected on the road. Many owner-operators and small fleets assume coverage works the same across different policies, but motor truck cargo insurance and general liability insurance protect very different risks. Understanding what is required versus what is optional can be the difference between a covered claim and an expensive setback.

Why Florida Trucking Businesses Need the Right Insurance Mix

Florida has one of the busiest freight networks in the country. High delivery volume, major ports activity, and unpredictable weather all contribute to higher cargo claims. As freight activity increases, risk exposure rises as well.

Owner-operators and small trucking companies face serious financial pressure when something goes wrong. A damaged shipment or customer lawsuit can quickly exceed what a small business can afford. Coverage misunderstandings are common. Many drivers assume general liability insurance protects their freight, but it does not. Others believe cargo insurance covers damage to a customer’s property, which it does not.

A clear understanding of commercial trucking insurance helps Florida truckers avoid coverage gaps and meet the expectations of brokers, shippers, and clients.

What Motor Truck Cargo Insurance Covers

Motor truck cargo insurance protects the goods you haul, not your truck or general business operations. This coverage applies when freight is damaged, stolen, or lost while under your care.

Cargo insurance policies typically cover situations such as:

- Accidental damage during transit

- Load shifts caused by sudden stops

- Theft of freight

- Fire or collision-related losses

- Water damage or spoilage when applicable endorsements are in place

This coverage is especially important for:

- Owner-operators

- Hotshot carriers

- Box truck contractors

- Amazon Relay drivers

Small fleets hauling customer freight

Shippers often require proof of motor truck cargo insurance before releasing loads. Contracts may also specify coverage limits based on the type of freight, such as electronics, produce, or construction materials.

Is Cargo Insurance Required in Florida?

By state law, Florida does not require motor truck cargo insurance for every trucking operation. However, most paid freight opportunities do need it. Brokers, load boards, Amazon Relay, and retail shippers typically require cargo coverage before allowing drivers to haul freight. In addition, the Florida Highway Safety and Motor Vehicles agency outlines several commercial insurance requirements that truckers must meet when registering and operating vehicles in the state.

Intrastate-only carriers often encounter this requirement when attempting to book loads and are declined for missing cargo coverage.

Real Example 1: Damaged Freight After Sudden Braking

A small Florida carrier hauling furniture along the I-4 corridor encounters unexpected traffic. The driver brakes suddenly, causing unsecured items to shift and crack several pieces of wood. The customer rejects the shipment.

Motor truck cargo insurance applies in this situation. It covers the damaged freight and prevents carriers from paying out of pocket. General liability insurance would not respond because the loss involves customer cargo, not third-party property damage.

Real Example 2: Theft at a Rest Stop

A box truck driver parks overnight at a Florida Turnpike rest area. Thieves cut the rear lock and steal several pallets of electronics. Motor truck cargo insurance covers the stolen freight.

Without this coverage, the driver would be responsible for the full value of the loss.

Florida’s high cargo theft rate makes this scenario especially relevant for local and regional haulers.

What General Liability Insurance Covers

General liability insurance protects your business operations, not the freight. It applies when your business causes bodily injury or property damage that is unrelated to the goods you transport.

General liability insurance helps with:

- Customer injuries at your office or yard

- Property damage at a delivery site that is not cargo-related

- Lawsuits tied to your business operations

- Damage caused during loading or unloading that affects the customer’s property, not their freight

This coverage is essential for trucking companies that interact with customers, operate warehouses, or deliver inside homes or businesses.

Is General Liability Required in Florida?

General liability is not required by Florida state law for truckers. However, many warehouses, freight brokers, and customer locations require proof of coverage. It remains a key layer of protection for any Florida business that interacts with the public.

Real Example: Customer Injury at Your Business Location

A customer walks across your lot to pick up paperwork. They slip on a wet surface and injure their shoulders. General liability insurance protects your business from medical expenses or legal action. Cargo insurance does not apply in this situation.

Real Example: Property Damage During Loading or Unloading

A driver delivering appliances in Tampa accidentally bumps a refrigerator into a wall, damaging the customer’s drywall. General liability insurance covers the damage. Motor truck cargo insurance applies only if the freight is damaged.

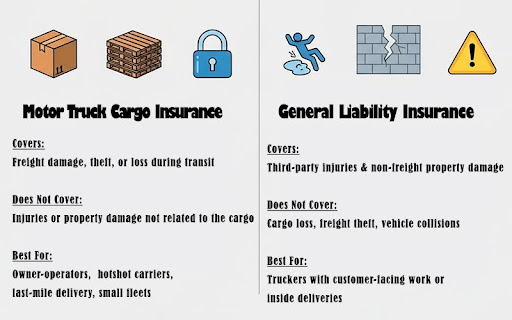

Cargo Insurance vs. General Liability: Side-by-Side Comparison

| Coverage Type | What It Covers | What It Does Not Cover | Who Needs It |

| Motor Truck Cargo Insurance | Damage, loss, or theft of freight | Injuries or property damage unrelated to freight | Owner-operators, hotshot drivers, last-mile delivery, small fleets |

| General Liability Insurance | Third-party injury and non-freight property damage | Cargo loss, collision damage, theft of freight | Truckers with customer-facing operations or inside delivery |

Optional but Recommended Coverages for Florida Truckers

Florida’s trucking environment makes several optional coverages worth considering:

- Non-trucking liability protects drivers when operating the truck off the job.

- Trailer interchange insurance is required when hauling someone else’s trailer.

- Inland marine insurance protects tools or equipment carried in the truck.

- Physical damage coverage protects your truck from collision, fire, or theft.

Many Florida trucking businesses assume they only need cargo and auto liability coverage. In practice, coverage gaps can develop quickly without these additional protections.

How Much Does Cargo Insurance Cost in Florida?

Cargo insurance costs vary because each trucking operation carries different levels of risk. Several factors influence pricing:

- reight Type: High-value goods such as electronics or pharmaceuticals typically cost more to insure than furniture or packaged goods.

- Load Value: Higher-value shipments increase overall risk exposure.

- Operating Radius: Longer routes mean more time on the road and increased exposure to potential losses.

- Driver Experience: Newer drivers often face higher premiums due to limited driving history.

- Deductibles: Choosing a higher deductible can lower your premium, but increases out-of-pocket costs when a claim occurs.

- Claims History: Prior losses often raise premiums because they indicate higher risk.

Florida also presents unique challenges. Storms, high humidity, and heavy port traffic can affect both the type of freight hauled and the risks involved. Cargo theft hotspots and long highway routes further increase exposure, which insurers factor into premium calculations.

How to Apply for Motor Truck Cargo Insurance

Applying for motor truck cargo insurance can feel complex, especially for those new to the Florida trucking industry. However, the process becomes more manageable once you understand what insurers look for. Carriers use your application to judge the risk your business presents, so providing complete and accurate information is essential to secure appropriate coverage and competitive rates.

Information You Must Provide

Florida truckers should expect to share:

- Business name and operating authority (intrastate or interstate): Insurers verify FMCSA or Florida state authority to confirm active and compliant operations.

- Type of freight hauled: Examples include electronics, household goods, furniture, construction materials, produce, or medical supplies.

- Radius of operation: Local, regional, statewide, or a defined mileage range.

- Driver experience: Years of experience, CDL status, and any formal safety training.

- Vehicle information: Year, make, model, VIN, and trailer details.

- Security practices: How freight is secured, parking locations, and any locks or alarm systems used.

Providing these details helps the insurers understand your operation and determine appropriate coverage limits.

Typical Questions on a Motor Truck Cargo Insurance Application

Insurers ask targeted questions to identify risk patterns:

- What is your average and maximum cargo value per load?

Higher-value loads increase potential claim severity. - Do you haul high-risk commodities?

Items such as electronics, seafood, alcohol, or pharmaceuticals often require specialized underwriting. - How is your cargo secured?

Details about load bars, straps, bulkheads, and seal procedures help insurers evaluate safety practices. - Where do you park overnight?

Safe parking, including well-lit areas, fenced lots, or secure depots, reduces the risk of theft. - Have you had prior claims or losses?

A clean claims history can lead to better pricing and faster approval.

Florida insurers carefully evaluate these factors, given the state’s higher cargo theft rates and greater exposure to severe weather than many other regions.

How Insurers Assess Risk

Underwriters review several factors before approving cargo insurance policies:

- Type of freight: High-value or easily stolen items increase risk.

- Driver and business experience: Greater experience typically leads to fewer losses.

- Route consistency: Predictable routes are generally easier to insure than constantly changing ones.

- Claims history: Past losses can indicate higher risk.

- Preventive measures: Parking security, alarms, GPS tracking, lock requirements, and loading procedures all help reduce risk.

For Florida truckers, demonstrating strong security practices and consistent routes can significantly improve application outcomes.

Florida-Specific Considerations

When it comes to insurance in Florida, understanding the local climate and potential theft risks is crucial. Underwriters typically inquire about several key factors, including:

- Storm planning during hurricane season

- Freight temperature sensitivity in extreme heat

- Whether cargo is left unattended in public rest areas

- Coastal route exposure and its impact on risk

Providing clear and complete answers helps insurers price coverage accurately.

How to Avoid Delays or Denials

Many Florida truckers experience delays due to incomplete applications. To avoid issues:

- Confirm your operating authority (FHSMV or FMCSA) is active and current.

- Provide accurate descriptions of the freight you haul.

- Avoid leaving blanks, as unanswered questions often lead to follow-up requests.

- Be honest about your claims history; insurers can verify it.

- Provide copies of commercial leases if you operate from a yard or warehouse.

How Terra Insurance Helps Florida Truckers Get the Right Coverage

Terra Insurance Services helps Florida trucking businesses understand and secure the coverage they need. Our team:

- Works daily with owner-operators and small trucking companies

- Compares multiple carriers to find suitable cargo insurance options

- Provides personal guidance instead of automated online quotes

- Understands Florida freight risks from Miami to Jacksonville

- Assists with completing motor truck cargo insurance applications correctly

- Helps ensure compliance with broker and shipper requirements

Florida truckers choose Terra for clear guidance, reliable protection, and support from professionals who understand their business.

Get Started With a Free Coverage Review

Choosing the right combination of cargo insurance and general liability insurance helps protect your freight, business, and income. Proper coverage matters whether you haul produce, appliances, construction materials, or last-mile deliveries across Florida.