If you drive a truck in Florida, you have likely heard different opinions about bobtail insurance, non-trucking liability, and primary auto insurance. Many owner-operators and leased drivers assume these coverages overlap more than they actually do. Others believe a single policy protects them in every situation, only to learn later that coverage depends on how and when the truck is used.

This confusion is common, especially among Florida truckers who move between personal driving, deadheading, and active hauling. We frequently see drivers in Florida search for bobtail insurance to answer a practical question: What coverage applies when I am not pulling a load? This article explains how bobtail and primary auto insurance typically work, when each may apply, and how Florida truckers can think about coverage more clearly.

What Is Bobtail or Non-Trucking Liability Insurance?

Bobtail insurance, often grouped with non-trucking liability insurance, is designed to provide liability coverage when a truck is being operated off dispatch. In simple terms, it may apply when a driver is not actively hauling a load for a motor carrier.

Bobtail insurance coverage typically applies when:

- The truck is being driven without a trailer.

- The driver is not under dispatch.

- The vehicle is used for personal or limited non-business purposes.

Leased drivers most commonly carry this type of coverage. When a driver is leased to a motor carrier, the carrier’s primary auto insurance usually applies only while the driver is operating under dispatch and under the carrier’s authority. When that same driver is off duty or using the truck for personal reasons, the carrier’s policy often does not apply. That is where bobtail insurance may come into play.

It is important to understand that bobtail insurance does not usually cover damage to your own truck. It is liability coverage, meaning it may help cover injuries or property damage to others if you are involved in an accident during qualifying off-dispatch driving.

What Is Primary Auto Insurance?

Primary auto insurance is often part of a broader commercial auto insurance program that supports day-to-day trucking operations. Motor carriers typically require this coverage, which applies when the truck is being used for business purposes under the carrier’s authority.

Primary auto insurance is designed to cover:

- Liability for accidents while hauling loads

- Driving under dispatch for a carrier

- Business-related trucking operations

In many cases, the motor carrier carries the primary auto policy and lists leased drivers under that coverage. When a driver is hauling freight, traveling to pick up a load, or otherwise operating under dispatch, primary auto insurance is usually the coverage that applies.

The key difference is scope. Primary auto insurance is tied to business operations, while bobtail insurance coverage is typically limited to non-business or off-dispatch use.

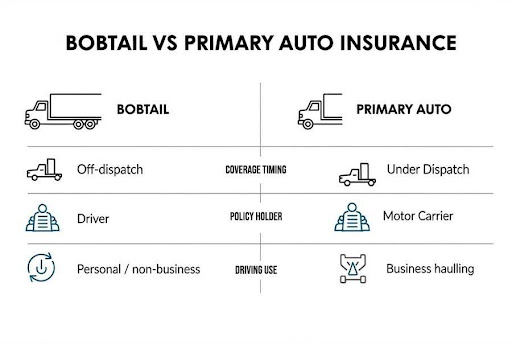

Bobtail vs Primary Auto Insurance: The Key Differences

Understanding the difference between these two coverages can help prevent costly misunderstandings and denied claims.

When Coverage Applies

- Bobtail insurance often applies when off dispatch and not hauling freight.

- Primary auto insurance typically applies when the vehicle is under dispatch or hauling loads.

Who Usually Carries the Policy

- The driver often purchases bobtail insurance.

- The motor carrier usually provides primary auto insurance.

Types of Driving Covered

- Bobtail insurance may cover personal use or limited non-business driving.

- Primary auto insurance covers business-related trucking activity.

Common Misunderstandings

- Assuming Bobtail insurance covers all driving without a load.

- Believing primary auto insurance applies during personal use.

- Not reviewing how lease agreements define dispatch status.

These differences matter because coverage depends on how the truck is being used at the time of an incident, not simply whether a trailer is attached.

When You Actually Need Bobtail Insurance in Florida

Bobtail insurance in Florida varies by operation, but certain situations commonly lead drivers to carry it. We often see coverage gaps occur when dispatch status is misunderstood rather than when coverage is missing entirely.

You may need bobtail insurance when:

- Driving the truck without a trailer for personal reasons

- Traveling between dispatches without a load

- Using the truck for errands or commuting when not under carrier authority

Deadheading situations can be confusing. Some deadheading is considered part of business operations, especially when returning from a dispatched delivery. In those cases, primary auto insurance may still apply. Other deadheading scenarios may be classified as off-dispatch. This distinction often depends on carrier agreements and how the trip is documented.

Because Florida trucking routes often involve port runs, regional deliveries, and frequent dispatch changes, many drivers carry bobtail insurance to help address gaps that can occur outside of active hauling.

When Primary Auto Insurance Is Needed

Bobtail insurance coverage is not designed to replace primary auto insurance. There are many situations where bobtail coverage alone is typically not sufficient.

Primary auto insurance is generally needed when:

- You are under dispatch

- You are hauling freight

- You are traveling to pick up or deliver a load

- Your carrier requires coverage under its authority

Motor carriers usually specify when their insurance applies and when drivers are responsible for separate coverage. Under FMCSA authority rules, liability coverage is tied to whether a driver is operating under a carrier’s dispatch and authority, not simply whether the truck is loaded. In Florida, where leased driver arrangements are common, understanding this distinction is critical.

Bobtail insurance is intended to complement primary auto insurance, not replace it. Carrying only bobtail insurance while operating under dispatch can create serious coverage gaps.

Common Mistakes Florida Truckers Make

Many insurance problems stem from misunderstandings rather than a lack of coverage.

Common mistakes include:

- Assuming Bobtail insurance covers all non-loaded driving.

- Not realizing that the carrier, not the driver, defines off-dispatch status.

- Purchasing coverage without reviewing lease agreements.

- Believing Bobtail insurance and non-trucking liability are separate policies.

- Carrying coverage that does not align with actual driving behavior.

Florida truckers often move between short-haul, regional, and personal use driving. Without reviewing how each activity is classified, it is easy to apply the wrong policy to the truck’s actual use.

How to Choose the Right Coverage Without Overpaying

Choosing the right coverage starts with understanding your actual operation rather than relying on assumptions.

Helpful steps include:

- Reviewing how often you drive off-dispatch

- Clarifying deadheading and personal use definitions with your carrier

- Identifying who provides primary auto coverage and when it applies

- Working with an agent familiar with Florida trucking operations

A bobtail insurance quote should be based on how you actually drive, not how coverage is commonly described online. Both over-insuring and under-insuring often result from unclear communication rather than pricing alone.

Drivers who take time to review their coverage needs typically avoid paying for policies that do not apply and reduce the risk of missing coverage that does.

Conclusion: Understanding Coverage Brings Confidence

Bobtail insurance and primary auto insurance serve different purposes. Neither is better than the other. They apply in different situations.

For Florida truckers, the right coverage depends on dispatch status, lease agreements, and day-to-day use. Understanding these differences helps drivers make informed decisions without relying on guesswork.

If you want clarity about bobtail insurance Florida options, consider requesting a bobtail insurance quote or speaking with an agent familiar with trucking operations.

Coverage Disclosure

Coverage terms vary by carrier agreement and policy language. Drivers should review their lease and insurance documents to confirm how dispatch status and coverage apply.